Whether you are starting a business for the first time or are already doing business in the United States, EOS strives to be your most trusted advisor by being readily accessible and easy to contact.

We serve as a “one-stop shop” for businesses and individuals in need of accounting, assurance, and US tax services. Our team of over 170 accounting and tax professionals spanning seven offices throughout the US is dedicated to serving our clients’ needs in both English and Japanese.

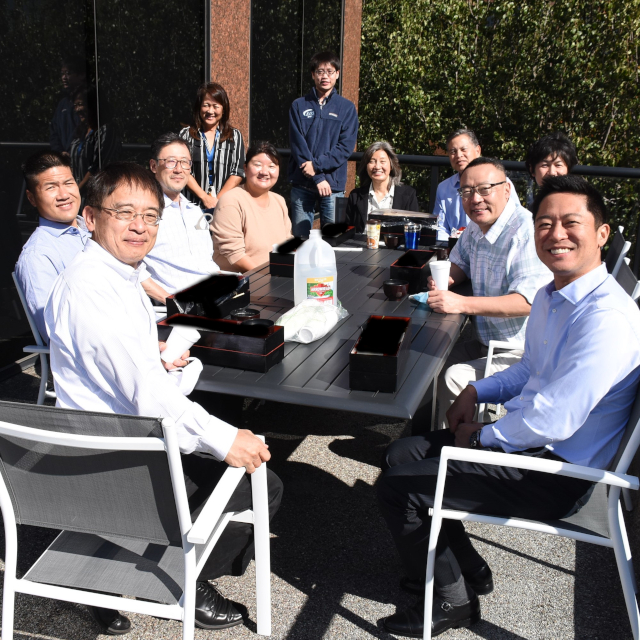

Meet our management team providing client services. With varying areas of expertise and a multitude of combined experience, our team of professionals aims to help our clients navigate complex transactions amidst ever-changing accounting rules and tax regulations.